How to Withdraw on Pocket Option Philippines

If you want to learn about the process of withdrawal from Pocket Option, this article provides detailed instructions. It covers important aspects such as withdrawal procedures and deadlines, providing you with a clear understanding of how to withdraw money from your account.

Pocket Option, headquartered in the Philippines since 2017, has rapidly made a name for itself as an impressive CFDs broker. Their service provides advanced trading capabilities combined with cutting-edge technical analysis tools. Pocket Option has now added Gcash, Grabpay and bank transfer as new deposit and withdrawal methods for customers.

Pocket Options Withdrawal Process

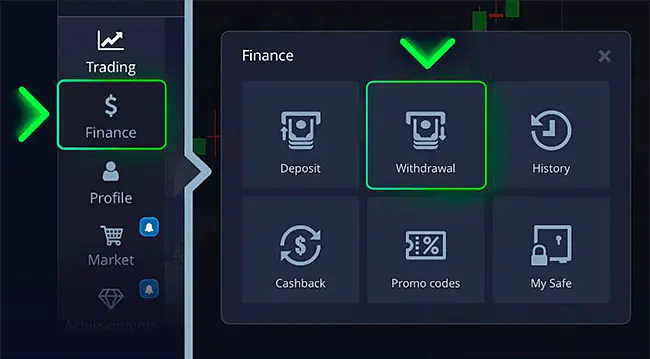

Step 1. Access the «Finance» tab and proceed to the «Withdrawal» page.

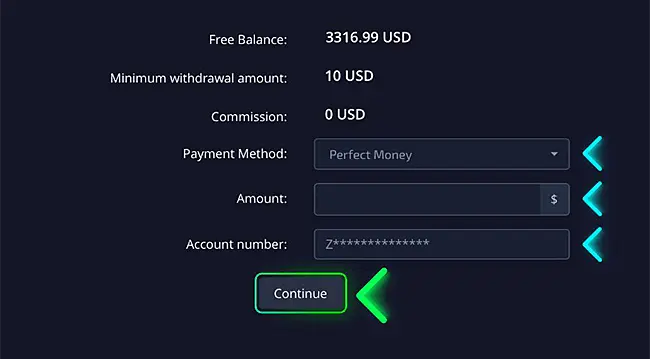

- Commence by inputting your desired withdrawal amount.

- Opt for an available payment method from the choices presented.

- Adhere to the prompts exhibited on the screen to finalize your submission.

It’s imperative to recognize that the minimum amount eligible for withdrawal can differ based on your selected withdrawal approach. Take this aspect into consideration when commencing the withdrawal process.

For those individuals interested in executing a fund withdrawal via the Visa/Mastercard route, here is a guide on the necessary steps:

- Direct yourself to the Finance Withdrawal page.

- Locate the designated «Payment Method» section and opt for the «Visa/Mastercard» alternative.

- Follow the directions provided on the screen to seamlessly proceed with your withdrawal application.

Please exercise caution regarding the stipulation that specific regions necessitate a preliminary bank card verification procedure before engaging the Visa/Mastercard withdrawal mechanism. For details, use the hints that appear or contact support, which is always on call.

Pocket Option Withdrawal Time for Different Types of Payments

How Long Does It Take To Withdraw From Pocket Option? Withdrawal processing times range from 1 to 3 business days, contingent on the chosen payment system. Below, you’ll find the typical durations for various methods:

- E-wallets: 3 to 12 hours;

- Bank Card: 24 to 36 hours;

- Cryptocurrency (BTC): 1 to 3 business days;

- Bank Transfer: 2 to 4 business days;

While the standard pocket option withdrawal time is 1 to 3 business days, there are instances where this timeframe can extend to up to 14 business days. Notification regarding such cases will be communicated through the support desk.

Currently, trading accounts on the platform are exclusively denominated in USD. However, withdrawals can be executed in different currencies depending on the payment method. Typically, funds received will be promptly converted to your account’s currency upon receipt. Do note that certain fees might be applied by the payment system you employ.

GCash

GCash has established partnerships with over 60 banks in the Philippines that enable you to transfer funds directly from your GCash account to these banks. There are no transaction fees attached, and the recipient will receive notification about the transfer via SMS.

Send money directly to your GCash account using the Send Money feature within the app. However, only fully verified GCash users are eligible for this service. All you have to do is enter their wallet address and amount you wish to transfer; then wait for a confirmation SMS from GCash’s team that they have processed your transaction immediately.

One of the key features that a mobile payment solution must offer is the capability of converting e-wallet balances into cash or transferring them back to bank accounts. This capability is essential for encouraging adoption and breaking down trust barriers for new technologies.

For instance, GCash and PayMaya both allow users to quickly withdraw cash using their linked prepaid cards at ATMs without having to pay the typical bank fee. This is an ideal way of getting your funds out quickly without incurring a large expense.

In addition, GCash and GrabPay offer an additional service that allows you to withdraw funds from your GrabPay wallet using either credit or debit card. This is a great way to ensure you always have enough credits on hand for any GrabFood or GrabCar order you place.

As with most e-wallets in the Philippines, GCash offers several deposit and withdrawal methods to suit your individual requirements. This includes both local and international currencies as well as bank deposits.

The most frequent and straightforward way to top up your GCash account is via Bank Transfer. This fast process allows you to transfer Philippine pesos directly from your bank into GCash. Alternatively, you may also use PayPal for this purpose.

You can also take advantage of GGives, a loan product offered by GCash that allows you to buy items now and pay them off later. This is an excellent way to save on interest rates and make purchases you might otherwise not have been able to finance.

Grabpay

Pocket Option Philippines makes withdrawing funds as simple as making a deposit. Their platform enables traders to trade currencies, gold, silver, commodities and stocks through an accessible web-based interface that can be accessed on mobile devices, laptops and desktop computers alike.

The pocket option withdrawal process in Philippines is swift and straightforward, with funds being automatically converted into your chosen currency according to your payment method and registered country. Furthermore, there are no fees associated with making a withdrawal or receiving money through pocket option Philippines.

Grabpay is an established online payment service in Southeast Asia that allows consumers to pay for rides, food delivery services and other purchases without using credit or debit cards. It provides a safe and convenient alternative for shopping online; shoppers simply need to enter a one-time password sent directly to their mobile phone to confirm the transaction.

To fund your GrabPay account, you have two options: link your bank account through the app or use InstaPay, an electronic fund transfer service. Both processes are fast and effortless; funds will appear in your wallet instantly.

InstaPay, administered by the Bangko Sentral ng Pilipinas (BSP), is available to both personal and business users alike. With InstaPay you can quickly transfer funds from your bank account or e-wallet into your GrabPay wallet – 24/7, 365 days a year!

You can send your GrabPay balance to another wallet via Person-to-Person transaction, with the following requirements: a valid mobile number and one-time password.

Once the transaction is complete, a one-time password will be sent directly to your mobile phone. This password enables you to confirm the transaction and complete your purchase.

It is essential that the email address on your GrabPay account matches that provided when signing up for a BDO banking account. Otherwise, any cash-ins may be declined.

Regarding pocket option withdrawal in the Philippines, there is a general guideline that the minimum withdrawal amount is $10, not including any promotions or discounts provided by the platform. Once an account is cleared for withdrawal, it typically takes only minutes to complete if there are no issues with it. It is highly recommended that you open a free demo account first in order to test out this process before using real funds.

Bank transfer

Bank transfers can be an ideal method for sending money overseas. They’re generally cost-effective, quick, and accessible from a mobile device or online platform. Furthermore, it’s usually linked directly to your bank account so doesn’t require any personal information from you.

Bank transfer from the Philippines allows you to send money directly to a recipient’s bank account, enabling them to receive it in their local currency without having to withdraw it first. This is especially useful for those without access to cash or who wish to avoid high fees charged by some transfer agents.

WorldRemit, Remitly, Xoom and MoneyGram are the leading bank transfer providers. Each offers a variety of payment methods such as cash pick-ups or airtime topups for their customers.

Payments can also be made directly from a bank account or prepaid card using an e-wallet. These are becoming increasingly popular in the Philippines and other countries as a convenient way to handle money transactions without needing large amounts of cash on hand.

In the Philippines, digital wallets are an attractive alternative to paying with cash as they provide many benefits such as low transaction fees. This method has become particularly popular among young people and can be utilized by both individuals and businesses alike.

A Philippine e-wallet is an efficient and convenient way to transfer funds between friends, family members, or business partners. It also supports payments and withdrawals through bank accounts, debit cards, and credit cards.

In the Philippines, there are various e-wallets that offer similar services. Some even boast features like instant deposit or transfer.

Another great benefit is that e-wallets provide a secure and convenient method for sending money abroad. They’re particularly beneficial to those without access to banks or credit cards.

Sending money overseas via an e-wallet is a fast and secure way to send funds, as it uses an encrypted connection that keeps your financial details safe. Plus, e-wallets allow you to bypass costly fees that some banks charge for international transfers.

Credit card

Credit cards offer you the convenience of making purchases without worrying about your bank account getting raided. However, it’s important to use them responsibly; if not managed carefully, they could lead to financial trouble.

Credit cards are revolving loans that you can use to purchase goods and services. Their credit limit is usually determined by your income and credit history, so it’s essential to know your limits before making large purchases with your card – otherwise, interest charges and higher monthly bills may arise if the balance isn’t settled by the due date.

A credit card’s greatest advantage is that you can earn rewards and bonuses for using it responsibly. These typically include cash back or travel deals, which can be incredibly helpful to those with frequent spending habits.

Before you can start earning card miles, however, you must complete the card verification process. At this stage, you’ll be asked to upload photos of both the front and back of your card as well as proof of address. This step is essential in ensuring no other users use your card when making purchases on the pocket option platform.

Thankfully, the process isn’t too lengthy and typically takes less than an hour for your money to be credited to your bank account. The only downside is that it may take up to 9 working days for funds to appear on your credit card statement; so be sure to check them frequently if you plan on making multiple withdrawals with this method.

For the simplest way to deposit or withdraw funds on the pocket option, an e-wallet might be your ideal solution. These services have low fees and are perfect for frequent transactions.

In addition to an e-wallet, you may also make deposits or withdrawals through your bank card or PayPal account. Depending on which banking provider you use, this process may take anywhere from 24 hours for a bank card deposit to up to five days for electronic wallet transfers.